Why I’m Launching My Company: A Personal Journey

Every morning, I wake up and ask myself a profound question: “Why am I starting my company?” This introspection has been a daily ritual for the past few days, but the journey to this realisation spans several months of contemplation and planning.

The Journey Towards Financial Freedom

A few months ago, my primary goal was to achieve financial freedom. My vision was to create a stable financial foundation that would allow me to relax for a few months, explore my spiritual side, and delve deeper into meditation—a practice I’ve cherished for the past eight years. My plan was straightforward: manage my finances diligently, spend a few hours each day analysing companies and studying businesses, and dedicate the 3-4 hours to meditation and reading the Upanishads.

Now, as I approach financial freedom, I question whether it’s truly a binary status. How much is enough to claim independence? In addition to financial freedom and a passion for equities, I’ve realized what I truly seek is a deeper purpose—making a meaningful impact. This company aligns my passion with a mission that drives me daily. I’m committed to dedicating the next decade to working hard, fearlessly, to simplify investing and help people manage their money better so they can focus on what truly matters.

Why Am I Starting My Company?

1. A Passion for Equity Investing

My journey in equity investing over the past 15 years has been nothing short of exhilarating. I have a tremendous passion for this field, and I simply love the space. My goal is to dedicate the next phase of my life to equity research and execution. I aim to identify the next “100-baggers” by leveraging technology and innovative strategies to build robust investment frameworks.

My journey started in 2009 with a book “One up on wall street”. I was so fascinated by the book but was not able to understand lot of financial concepts. I was in US that time. To understand the book, I read 11th and 12th class commerce books to understand the basics of accounting. After that , the book became easy of understand. If I remember , I read that book 10 times in 3 months. And then I created a software which captured all the important learning of that book and my first investment framework was born. I got few multi-baggers from that platform.

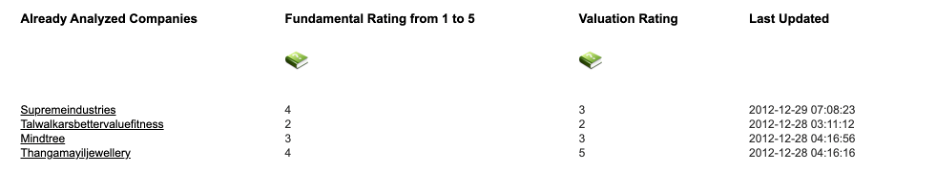

The Second investment platform that I built was in 2012. Here is the link to list of companies which I analysed in 2012 https://pupone.com/ListAnalyzedCompanies.php . Some of these companies have become 20x, 30x, 40X and there is a learning from one company.

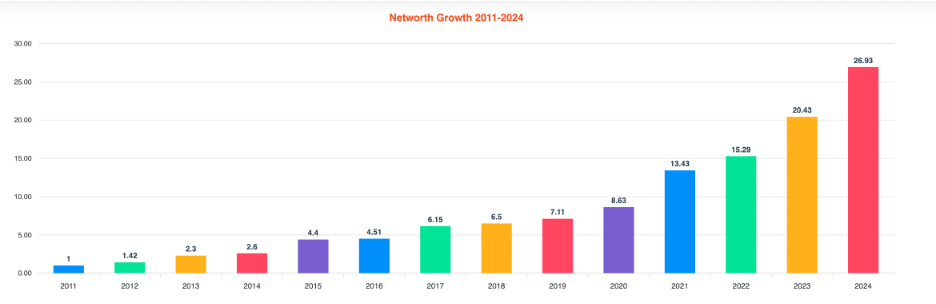

Over the past 11 years, I have achieved a respectable Compound Annual Growth Rate (CAGR) of 29.6%, and in the last five years within the IT sector alone, I have realised a CAGR of 33%, compared to the 22% CAGR of Nifty IT.

While I am grateful for these achievements, I recognize that there is always room for improvement. I am determined to elevate my performance further by continuously refining my investment strategies and embracing the lessons the market has to offer.

For the past 15 years, I have dedicated nearly every weekend to refining my investment strategies, understanding market dynamics, and learning from countless mistakes. This isn’t just work to me—it’s a passion that brings vitality and joy to my life

2. Helping Others Through Investment Skills

Beyond personal financial goals, I have a strong desire to use my skills for the betterment of others. Many people across various segments of society struggle with money management and financial planning. Countless people in India have spent 15-20 years or more working in jobs or businesses, yet they still worry about their daughters’ marriages, medical emergencies, or their children’s college fees.

Many, despite earning well, fear job loss or feel frustrated that their assets aren’t generating enough income—in other words, money isn’t working for them. There are also many women who, although they are working, still struggle to manage their finances and often rely on their fathers, husbands, or brothers to handle their money. What if these hardworking, talented women could excel in this area just like they do in other areas of life?

What if we could teach our children, college students, and young professionals the power of saving, compounding, and investing in great businesses? If done well, we’re talking about a world where money is less of a concern. I truly wish for this world. Sometimes, it’s almost unbearable to see an elderly person who has dedicated their life to a profession still struggling financially.

I know I can’t do this alone, but I’m starting anyway—because it’s the right thing to do and I’m fully committed to seeing it through.

Goal-oriented and process-based equity investing can address most of these concerns and ultimately also achieving financial freedom.

I want to dedicate the next phase of my life to helping individuals compound their wealth over time. By sharing my investment expertise, I aim to empower others to achieve financial stability and peace of mind. This mission has inspired me to launch a tech and AI-based asset management company that focuses on providing tailored investment solutions to a broad spectrum of clients.

Why SIHO?

With these motivations in mind, I am starting SIHO (Simplify Investing and Help Others)—a company driven by rigorous equity research and a core intention to help people. Our stakeholders include customers, employees, investors, and vendors, all of whom are integral to our mission.

Our Vision: We aspire to become the best equity research and asset management company in India. Our foundation is built on hiring the best talent, each passionate about using their skills for societal betterment while also achieving financial success.

Our Strategy:

-

- Democratising Wealth: Once our research engine is robust, we aim to extend our services to the Indian population. By maximizing the utilisation of their investments for compounding wealth and minimizing operational fees, we make financial growth accessible to a broader audience.

Priority

-

- Serving People with the Best Investing Strategies: Our primary focus is to help our clients achieve their financial goals through meticulously crafted investment strategies.

-

- (Core Member) First: Our core members are the backbone of SIHO. We prioritise creating a work environment where our team members enjoy the journey and grow alongside the company. By fostering a culture of collaboration, continuous learning, and shared success, we ensure that our core members not only thrive professionally but also achieve financial prosperity with us.

Starting SIHO is not just a business venture; it is the culmination of years of passion, experience, and a deep-seated desire to make a positive impact. By combining my love for equity investing with a mission to help others, I believe we can create a company that not only thrives financially but also contributes meaningfully to society.

Initially, we will be focusing on the mindset required for successful investing and the significant impact that equity investing can have on achieving our financial goals.At this stage, we’re focusing on a small, like-minded group of investors who resonate with our mission. This approach allows us to build a strong foundation with those who share our long-term vision. While we hope to open up to a wider audience in the future, for now, we believe keeping it exclusive will help us better serve our early supporters and ensure we’re creating meaningful value together

If you’d like to join us on this journey—whether as an investor or someone eager to learn—please fill out our Interest form. We will review your profile and get back if we think that there is an alignment on the vision and values.

For any other queries or feedback, feel free to reach out via the Contact , I prefer communication through email.

Thank you for taking the time to read about my journey and the reasons behind starting SIHO. I invite you to join us on this exciting path towards financial empowerment and societal betterment.

This is my personal investment journey and does not show the performance of SIHO Research as we have just opened this company.

The securities quoted are for illustration only and are not recommendatory*